PFA technology is only marketed in Europe, and yet, it has been dominating the electrophysiology market by storm

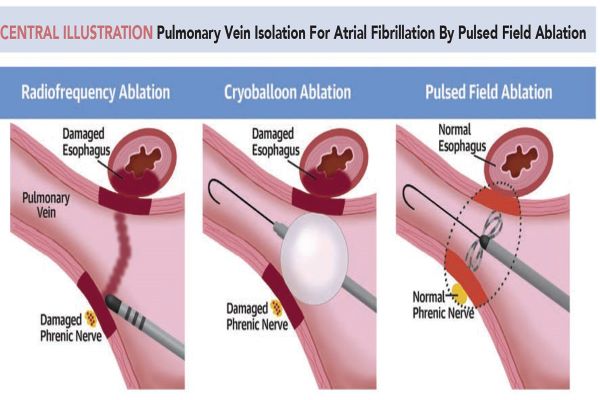

Pulsed-field ablation (PFA) is reshaping the electrophysiology landscape, marked by Boston Scientific's Farapulse PFA system gaining CE mark approval in 2021. The Farapulse PFA system witnessed a remarkable 254% CAGR in patient treatments from 2021 to 2023. PFA's nonthermal, rapid lesion creation capability has earned it favor among European physicians, heralding potential cannibalization of traditional ablation catheters as PFA technology expands beyond Europe, according to GlobalData, a leading data and analytics company.

Joselia Carlos, Medical Device Analyst at GlobalData, comments: “PFA technology is only marketed in Europe, and yet, it has been dominating the electrophysiology market by storm. Based on KOL surveys conducted in Europe, most doctors are now preferring PFA catheters over other ablation catheters because of PFA’s ability to create lesions nonthermally and within milliseconds. GlobalData predicts product cannibalization amongst ablation catheters as PFA catheters become marketed in other regions besides Europe.”

Medtronic received CE mark for its Affera Mapping PFA system in March 2023. Another competitor, Biosense Webster, is also developing its own PFA system—the Veripulse. Unlike Boston Scientific’s Farapulse and Medtronic’s Affera Mapping PFA systems, the Veripulse has not received any form of regulatory approval yet as it is still undergoing clinical trials.

Carlos continues: “Interestingly, all three companies have reported that their PFA catheter will receive FDA approval, and therefore, will be marketed in the US in 2024. It will be interesting to see whose PFA catheter will receive FDA approval first.”

PFA catheters are typically used during electrophysiology procedures to treat atrial fibrillation (Afib). More recently, Boston Scientific’s Watchman FLX has also been dominating the Afib market. In 2022, the number of patients implanted with a Watchman FLX grew by almost 234%, in comparison to the number of procedures in 2018. Despite the Watchman FLX’s aggressive CAGR, the electrophysiology market still had the highest share in terms of the number of Afib procedures at 52% in 2022.

Carlos concludes: “Electrophysiology procedures remain the number one preferred treatment for Afib. While the Watchman FLX has certainly shaken up the Afib market, PFA technology has solidified the electrophysiology space as the market leader within the Afib market. However, instead of gaining more shares within the Afib space, more ablation procedures will likely be performed with PFA in lieu of traditional ablation technologies.”

Subscribe To Our Newsletter & Stay Updated