The proposed scheme to include low-income NRIs under Ayushman Bharat (PM-JAY) would ensure life-long coverage for each individual along with their spouses

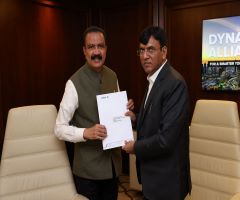

Dr. Azad Moopen, (left), Founder Chairman and Managing Director of Aster DM Healthcare presenting his letter to Dr. Mansukh Mandaviya, India’s Hon’ble Minister of Health and Family Welfare, Chemicals & Fertilizers

The Indian government should look at making provisions to include low-income Non-Resident Indians (NRIs), to be part of the Ayushman Bharat (PM-JAY) scheme and also create participatory insurance for NRI returnees. These two proposals were submitted by Dr. Azad Moopen, Founder Chairman and Managing Director of Aster DM Healthcare and also Director of NORKA (Non-Resident Keralite Affairs), to Dr Mansukh Mandaviya, Hon’ble Minister of Health and Family Welfare, Chemicals & Fertilizers – India, who was in Dubai for the EXPO 2020.

Speaking on the proposed scheme, Dr. Moopen said, “India has over 18 million people living outside with UAE, US and Saudi Arabia hosting the largest number of migrants. Among these, there is a large number of blue-collar workers who have only meagre savings when they return to India after retirement. This is especially true for a large number of manual workers in GCC countries that has the largest density of low-income NRI population. Major illnesses like heart attack, stroke, cancer mostly strike after the age of 60 requiring huge spending for treatment. Unfortunately, majority of them are not eligible for coverage under insurance schemes like Ayushman Bharat (PM-JAY) because of their foreign employment history.”

The proposed scheme to include low-income NRIs under Ayushman Bharat (PM-JAY) would ensure life-long coverage for each individual along with their spouses. The scheme for participatory insurance for NRI returnees proposes an option for NRIs to remit the premium on a monthly or annual basis while they are working abroad. In general, NRIs start working abroad by the age of 25 to 30 years and return to India upon retirement by 60 years of age. They could remit the premiums for a period of 20 to 30 years in small instalments. In this way, a significant amount will accumulate while they are outside the country, which can be utilized to provide coverage for the NRI and spouse for the rest of their lifetime.

Also attending the meeting was Hon. Joint Secretary of Ministry of Health & Family Welfare Lav Agarwal; H.E Sunjay Sudhir – Ambassador of India to UAE; and Dr. Aman Puri - Hon. Consul General of India in Dubai, key business leaders and delegates from UAE and Alisha Moopen – Deputy Managing Director, Aster DM Healthcare

Subscribe To Our Newsletter & Stay Updated